why is aclu not tax deductible

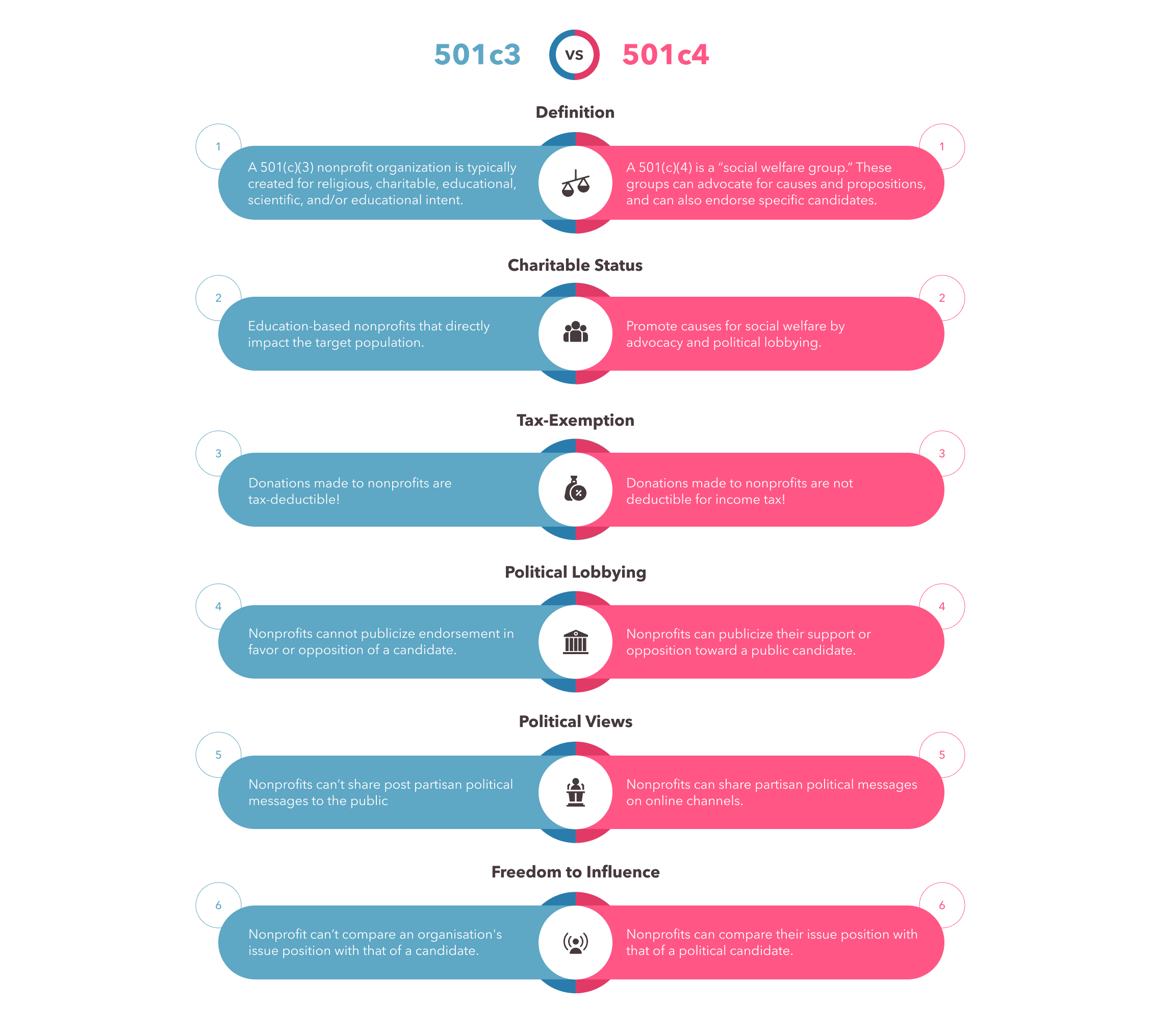

But the ACLU Foundation is a 501c3 organization just like most nonprofits. Membership fees fund the Union which does our political lobbying and advocacy work.

The American Civil Liberties Union Foundation ACLU Foundation is a 501 c 3.

. Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union. We are at a pivotal moment in our nations history.

A donor may make a tax-deductible gift only to the ACLU Foundation. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy.

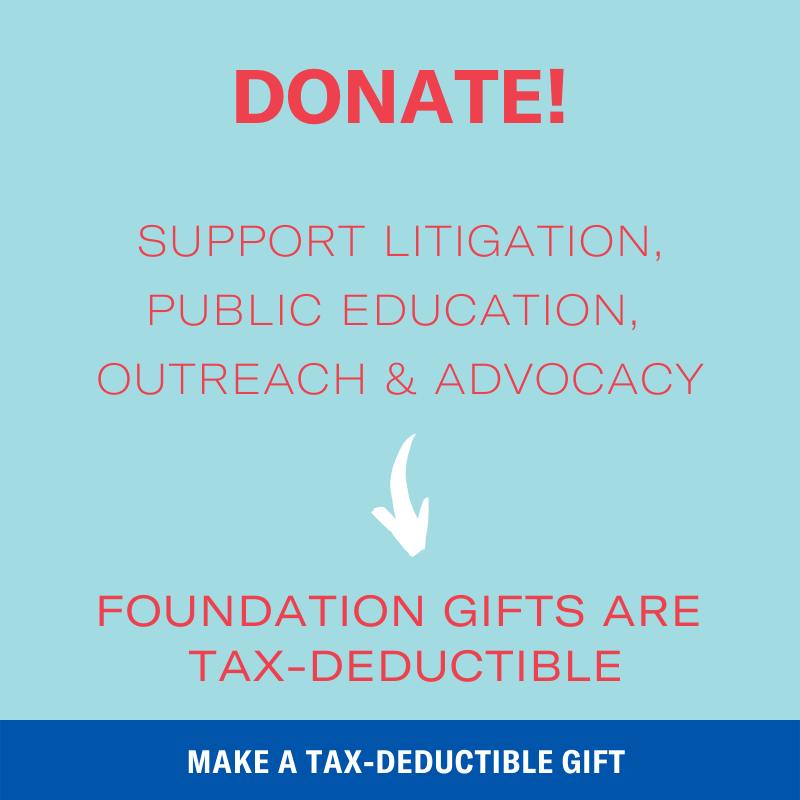

Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. Tax-deductible donations fund the ACLU Foundation which does our public education outreach and litigation. The rules for a tax-deductible non-profit organizations are wider than just charities.

Making a gift to the ACLU via a wire transfer allows you to have an immediate impact on the fight for civil liberties. The ACLU is actually two very closely associated institutions the American Civil Liberties Union and the ACLU Foundation. The educational programs of the ACLU and their legal defense of the Bill of Rights in the courts would qualify for tax-ded status if that was all they did.

Is the ACLU an organization that falls under charitable donations. They do lobby Congress though and they lobby state legislatures in many states. You can read all about it on this page of the ACLUs website.

You can defend and advance civil liberties by donating to either the American Civil Liberties Union ACLU or the ACLU Foundation. It is the membership organization and you have to be a member to get your trusty ACLU card. And Thin Ice is correct - no court in the.

Gifts to the ACLU allow us the greatest flexibility in our workWhile not tax deductible they advance our extensive litigation communications and public education programs. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds. The ACLU proudly claims that they are wholly non-partisan.

Since that work is political membership dues and gifts designated to the Union are not tax-deductible. Jay at Stop the ACLU makes a compelling case that the ACLU should lose its tax exempt status. Because of its lobbying status you cant take a tax deduction for your donations to the ACLU.

A donor may make a tax-deductible gift only to the ACLU Foundation. Is the ACLU a political organization. For more information see the ACLU website on this.

1 hour agoHeard pledged 35M to the ACLU after she received 7 million in her divorce from Depp but only 13 million went to the ACLU so far. It is the membership organization and you have to be a member to get your trusty ACLU card. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible.

It portrays itself as an objective organization that is neither liberal nor conservative Republican nor Democrat. ACLU monies fund our legislative lobbying--important work. Why Is Aclu Not Tax Deductible.

The ACLU is a 501 nonprofit corporation but gifts to it are not tax-deductible. The American Civil Liberties Union ACLU is a 501 c 4 - a tax-exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore not tax deductible. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible.

They say instead that they are a public interest organization. Thats why racial justice organizations like the Center for Media Justice are calling for a ban on the governments use of this dystopian technology and why ACLU advocates from California to Massachusetts are pushing for bans on the technology in cities nationwide. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union.

For more details please email us. Donations to the ACLU are not tax deductible while donations the the ACLU Foundation are.

Aclu Donations How To Make A Tax Deductible Gift Money

Pin By Wan M On Politics History Current Events Global Dod Family Separation Make A Donation Supportive

I Wish Complaining About Taxes Was Tax Deductible Taxes Humor Tax Season Humor Accounting Humor

Give American Civil Liberties Union

Tax Deductible Bequest Language American Civil Liberties Union

Just Donated To Planned Parenthood Alabama For Anyone Who Feels Helpless In Our Current Political Climate This Is A Great Way To Make A Small Effort Towards Change R Thegirlsurvivalguide

Why Are Donations To The Aclu Not Tax Deductible Quora

101 Tax Write Offs For Business What To Claim On Taxes Small Business Tax Deductions Business Tax Deductions Tax Write Offs

Are Credit Card Fees Tax Deductible Discover The Truth

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And In The Streets

Ecommerce Tax Deductions You Need To Consider For Your Business Clickfunnels Business Tax Deductions Business Tax Small Business Tax Deductions

Victoria 3 Bet Repayment Log R Paradoxplaza

Why Are Donations To The Aclu Not Tax Deductible Quora

Did You Know There Was Medical Tax Deductions Available To You Healthcare Savemoney Business Tax Deductions Tax Deductions Small Business Tax

Get Our Printable Tax Deductible Donation Receipt Template Receipt Template Receipt Tax Deductions